As an entrepreneur, managing finances is a crucial aspect of running a successful business. One of the most important financial tasks is creating and tracking invoices, which can be time-consuming and prone to errors when done manually. Fortunately, there are numerous invoice accounting software solutions available that can simplify this process, saving you time and reducing the risk of errors. In this article, we will explore the best invoice accounting software for entrepreneurs, highlighting their features, benefits, and pricing plans.

What is Invoice Accounting Software?

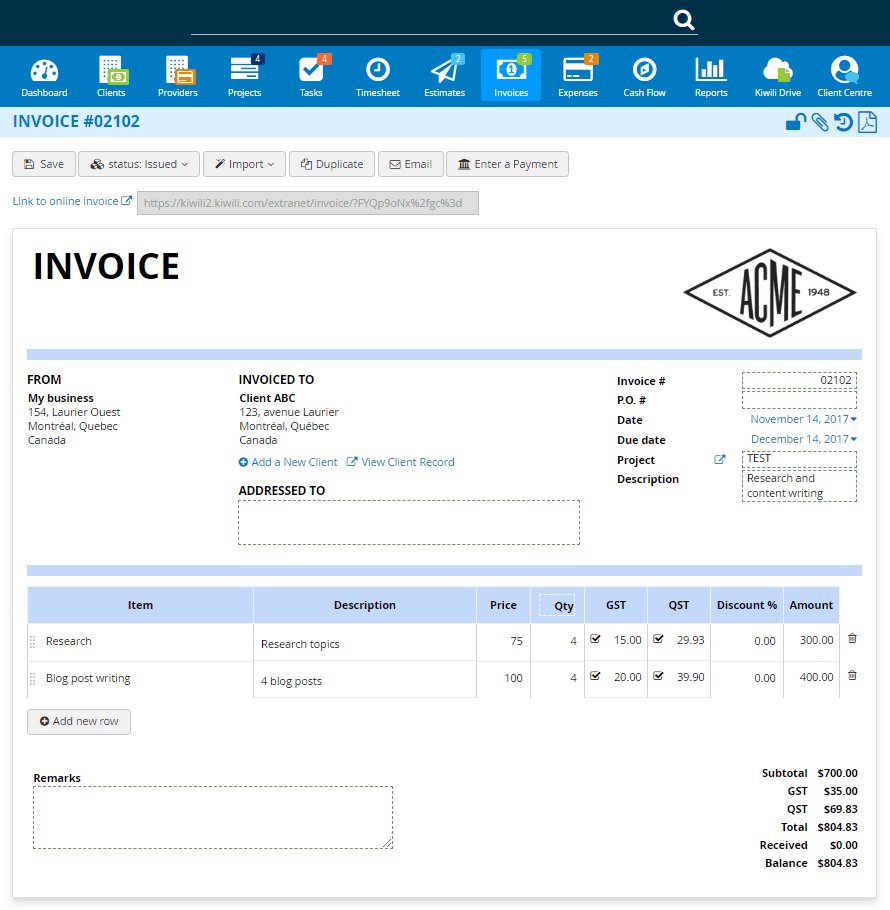

Invoice accounting software is a type of accounting software that enables businesses to create, send, and track invoices electronically. These software solutions typically include features such as invoice creation, payment tracking, and financial reporting, making it easier for entrepreneurs to manage their finances and stay on top of their cash flow.

Benefits of Using Invoice Accounting Software

Using invoice accounting software can bring numerous benefits to entrepreneurs, including:

- Time Savings: Automated invoicing and payment tracking can save entrepreneurs a significant amount of time, which can be spent on more important tasks such as growing their business.

- Error Reduction: Invoice accounting software can minimize errors associated with manual invoicing, such as incorrect calculations or forgotten payments.

- Improved Cash Flow: By sending invoices and tracking payments electronically, entrepreneurs can get paid faster, improving their cash flow and reducing the risk of late payments.

- Enhanced Professionalism: Invoice accounting software can help entrepreneurs create professional-looking invoices, which can enhance their business’s reputation and credibility.

- Financial Insights: Invoice accounting software can provide entrepreneurs with valuable financial insights, such as revenue tracking and expense management, to help them make informed business decisions.

Top Invoice Accounting Software for Entrepreneurs

Here are some of the best invoice accounting software solutions for entrepreneurs:

- QuickBooks: QuickBooks is a popular accounting software that offers a range of features, including invoice creation, payment tracking, and financial reporting. Pricing plans start at $10 per month.

- Xero: Xero is a cloud-based accounting software that offers features such as invoice creation, payment tracking, and financial reporting. Pricing plans start at $9 per month.

- FreshBooks: FreshBooks is a cloud-based accounting software that offers features such as invoice creation, payment tracking, and time tracking. Pricing plans start at $15 per month.

- Wave: Wave is a cloud-based accounting software that offers features such as invoice creation, payment tracking, and financial reporting. Pricing plans start at $19 per month.

- Zoho Invoice: Zoho Invoice is a cloud-based invoicing software that offers features such as invoice creation, payment tracking, and financial reporting. Pricing plans start at $9 per month.

Features to Look for in Invoice Accounting Software

When choosing an invoice accounting software, there are several features to look for, including:

- Invoice Creation: Look for software that allows you to create professional-looking invoices with ease.

- Payment Tracking: Choose software that enables you to track payments and send reminders to clients.

- Financial Reporting: Opt for software that provides financial insights, such as revenue tracking and expense management.

- Time Tracking: Consider software that includes time tracking features, which can help you track hours worked and generate invoices accordingly.

- Integration: Look for software that integrates with other business tools, such as payment gateways and accounting software.

Security and Support

When choosing an invoice accounting software, it’s essential to consider security and support. Look for software that:

- Data Encryption: Ensures that your financial data is encrypted and secure.

- Two-Factor Authentication: Offers two-factor authentication to prevent unauthorized access.

- Customer Support: Provides excellent customer support, such as phone, email, or live chat support.

- Regular Updates: Releases regular updates to ensure the software stays secure and up-to-date.

Pricing Plans

The pricing plans for invoice accounting software vary depending on the features and number of users. Here’s a brief overview of the pricing plans for the software mentioned earlier:

- QuickBooks: Pricing plans start at $10 per month for the Simple Start plan, which includes features such as invoice creation and payment tracking.

- Xero: Pricing plans start at $9 per month for the Early plan, which includes features such as invoice creation and financial reporting.

- FreshBooks: Pricing plans start at $15 per month for the Lite plan, which includes features such as invoice creation and time tracking.

- Wave: Pricing plans start at $19 per month for the Wave Plus plan, which includes features such as invoice creation and financial reporting.

- Zoho Invoice: Pricing plans start at $9 per month for the Basic plan, which includes features such as invoice creation and payment tracking.

FAQ

- What is the best invoice accounting software for small businesses?

The best invoice accounting software for small businesses depends on the specific needs of the business. However, popular options include QuickBooks, Xero, and FreshBooks. - How do I choose the right invoice accounting software?

To choose the right invoice accounting software, consider features such as invoice creation, payment tracking, and financial reporting, as well as security, support, and pricing plans. - Can I use invoice accounting software for free?

Some invoice accounting software solutions offer free plans or trials, but these often come with limited features. Paid plans typically offer more features and support. - How do I integrate invoice accounting software with other business tools?

Many invoice accounting software solutions integrate with other business tools, such as payment gateways and accounting software. Check the software’s documentation or contact customer support for more information.

Conclusion

Invoice accounting software is an essential tool for entrepreneurs, helping them streamline financial management, reduce errors, and improve cash flow. By choosing the right software, entrepreneurs can save time, enhance professionalism, and gain valuable financial insights. When selecting an invoice accounting software, consider features such as invoice creation, payment tracking, and financial reporting, as well as security, support, and pricing plans. By investing in the right invoice accounting software, entrepreneurs can focus on growing their business and achieving success.

Closure

Thus, we hope this article has provided valuable insights into The Best Invoice Accounting Software for Entrepreneurs: Streamlining Financial Management. We thank you for taking the time to read this article. See you in our next article!