As a business owner, managing bills and invoices is a crucial aspect of financial management. It can be a time-consuming and tedious task, especially if you’re still using traditional methods such as spreadsheets or paper-based systems. However, with the advancement of technology, there are now many accounting software options available that can simplify and streamline your billing and invoicing processes.

In this article, we’ll take a look at some of the best accounting software for managing bills and invoices, their features, and benefits. We’ll also discuss the importance of using accounting software for your business and provide some tips on how to choose the right one for your needs.

Why Use Accounting Software for Managing Bills and Invoices?

Using accounting software for managing bills and invoices can bring numerous benefits to your business. Some of the advantages include:

- Increased efficiency: Accounting software automates many tasks, such as data entry, calculations, and reporting, which saves you time and reduces the risk of errors.

- Improved accuracy: Accounting software helps ensure that your financial data is accurate and up-to-date, which is essential for making informed business decisions.

- Enhanced organization: Accounting software provides a centralized platform for managing all your financial data, including bills and invoices, which makes it easier to track and analyze your expenses.

- Better cash flow management: Accounting software helps you keep track of your accounts payable and accounts receivable, which enables you to manage your cash flow more effectively.

- Scalability: Accounting software can grow with your business, providing you with the flexibility to add new users, customers, and vendors as needed.

Best Accounting Software for Managing Bills and Invoices

Here are some of the best accounting software options for managing bills and invoices:

- QuickBooks: QuickBooks is one of the most popular accounting software options for small and medium-sized businesses. It offers a range of features, including invoicing, billing, and expense tracking, as well as advanced features such as project management and inventory tracking.

- Xero: Xero is a cloud-based accounting software that offers a user-friendly interface and a range of features, including invoicing, billing, and expense tracking. It also integrates with a wide range of third-party apps, including payment gateways and e-commerce platforms.

- FreshBooks: FreshBooks is a cloud-based accounting software that is designed specifically for small businesses and freelancers. It offers a range of features, including invoicing, billing, and expense tracking, as well as advanced features such as project management and time tracking.

- Zoho Books: Zoho Books is a cloud-based accounting software that offers a range of features, including invoicing, billing, and expense tracking. It also integrates with a wide range of third-party apps, including payment gateways and e-commerce platforms.

- Wave: Wave is a cloud-based accounting software that offers a range of features, including invoicing, billing, and expense tracking. It also provides a user-friendly interface and integrates with a wide range of third-party apps, including payment gateways and e-commerce platforms.

Features to Look for in Accounting Software

When choosing accounting software for managing bills and invoices, there are several features to look for, including:

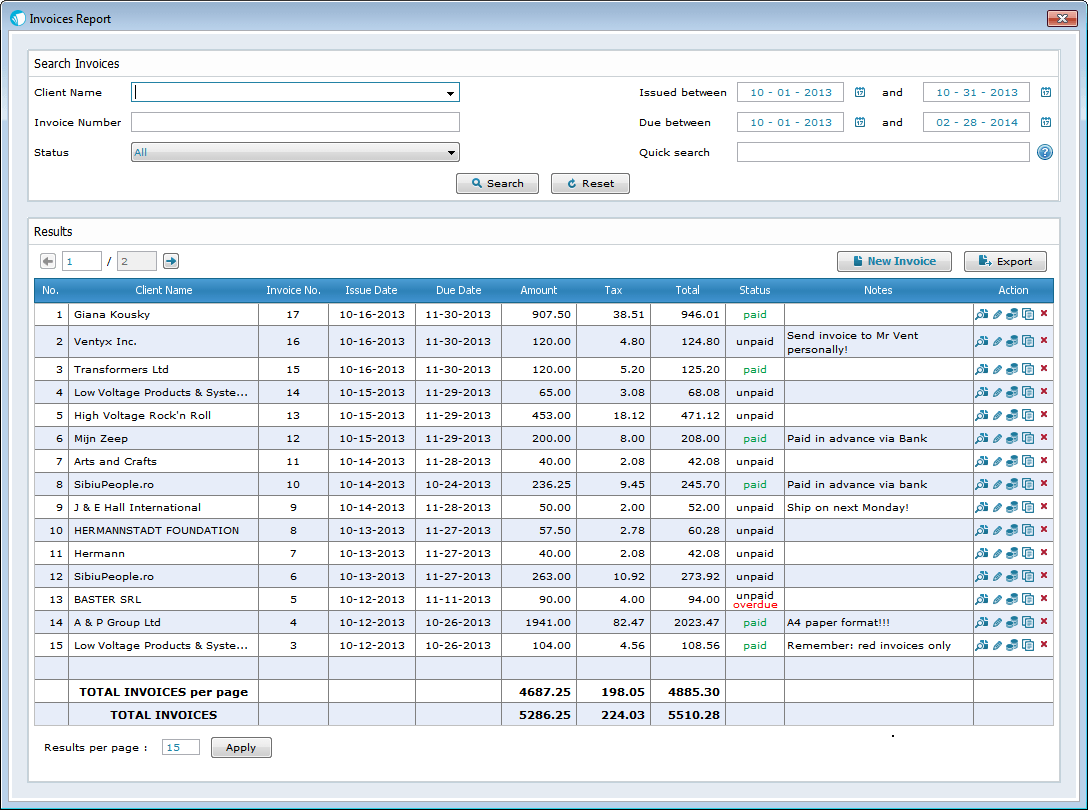

- Invoicing and billing: Look for software that allows you to create and send professional-looking invoices and bills, as well as track and manage payments.

- Expense tracking: Look for software that allows you to track and manage expenses, including receipts and invoices.

- Accounts payable and accounts receivable: Look for software that allows you to manage and track your accounts payable and accounts receivable, including vendor payments and customer invoices.

- Payment gateway integration: Look for software that integrates with payment gateways, such as PayPal or Stripe, to enable online payments.

- Mobile accessibility: Look for software that offers mobile accessibility, including apps for iOS and Android devices, to enable you to manage your finances on-the-go.

Tips for Choosing the Right Accounting Software

Here are some tips for choosing the right accounting software for your business:

- Assess your needs: Assess your business needs and identify the features that are most important to you.

- Consider your budget: Consider your budget and look for software that offers a pricing plan that fits your needs.

- Read reviews: Read reviews and testimonials from other users to get an idea of the software’s performance and customer support.

- Try before you buy: Try before you buy by taking advantage of free trials or demos to test the software and see if it’s a good fit for your business.

Frequently Asked Questions (FAQs)

- What is accounting software?: Accounting software is a type of software that is designed to help businesses manage their financial data, including bills and invoices.

- What are the benefits of using accounting software?: The benefits of using accounting software include increased efficiency, improved accuracy, enhanced organization, better cash flow management, and scalability.

- What features should I look for in accounting software?: Features to look for in accounting software include invoicing and billing, expense tracking, accounts payable and accounts receivable, payment gateway integration, and mobile accessibility.

- How do I choose the right accounting software for my business?: To choose the right accounting software for your business, assess your needs, consider your budget, read reviews, and try before you buy.

- Is accounting software secure?: Yes, accounting software is secure, with many providers offering robust security measures, including encryption, firewalls, and access controls.

Conclusion

Managing bills and invoices is a crucial aspect of financial management for businesses. Accounting software can help simplify and streamline this process, providing numerous benefits, including increased efficiency, improved accuracy, and enhanced organization. When choosing accounting software, consider features such as invoicing and billing, expense tracking, and payment gateway integration, and look for software that offers a user-friendly interface and mobile accessibility. By following these tips and considering your business needs, you can find the right accounting software to help you manage your bills and invoices effectively. Whether you’re a small business or a large enterprise, accounting software is an essential tool for managing your finances and driving business growth.

Closure

Thus, we hope this article has provided valuable insights into The Best Accounting Software for Managing Bills and Invoices. We appreciate your attention to our article. See you in our next article!