As a business owner, managing your company’s finances is crucial to its success. Two essential aspects of financial management are accounts receivable and accounts payable. Accounts receivable refers to the amount of money that customers owe to your business, while accounts payable represents the amount of money that your business owes to its suppliers or creditors. In this article, we will explore the best accounting software for managing accounts receivable and payable, helping you to streamline your financial operations and make informed decisions.

Why Accounting Software is Important

Manual accounting methods can be time-consuming, prone to errors, and inefficient. Accounting software, on the other hand, automates many tasks, such as invoicing, payment tracking, and reconciliation, freeing up your time to focus on other aspects of your business. Moreover, accounting software provides real-time visibility into your company’s financial performance, enabling you to identify areas for improvement and make data-driven decisions.

Key Features of Accounting Software for Managing Accounts Receivable and Payable

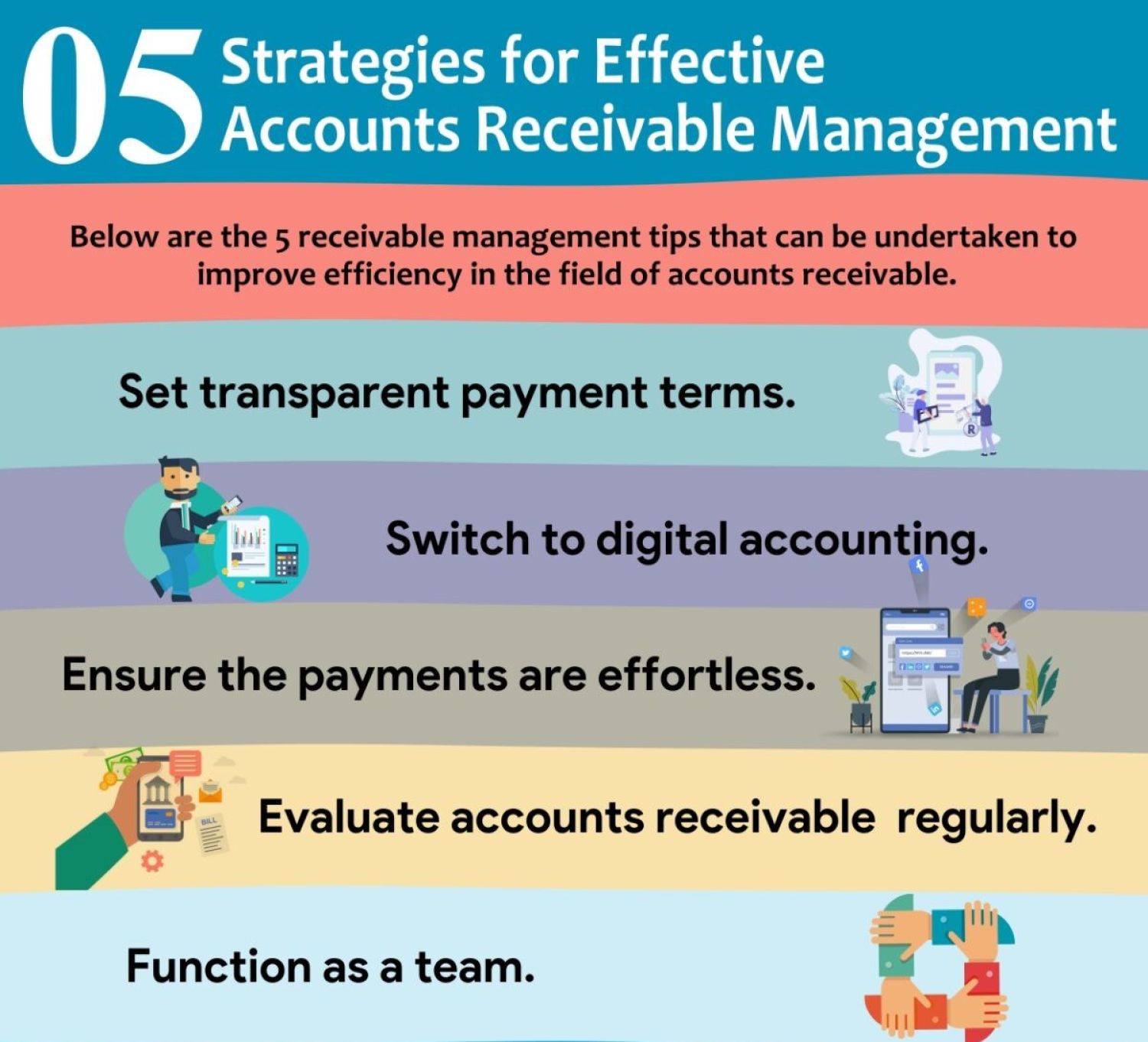

When selecting accounting software for managing accounts receivable and payable, consider the following key features:

- Invoicing and Billing: Look for software that allows you to create professional invoices and bills, with customizable templates and automated payment reminders.

- Payment Tracking: Choose software that enables you to track payments, including partial payments, and apply them to the correct invoices.

- Accounts Receivable and Payable Management: Opt for software that provides a comprehensive view of your accounts receivable and payable, including aging reports and payment schedules.

- Reconciliation: Ensure that the software offers automated bank reconciliation, making it easy to match transactions and identify discrepancies.

- Reporting and Analytics: Select software that provides detailed reports and analytics, such as accounts receivable and payable turnover, and days sales outstanding (DSO).

- Integration: Consider software that integrates with other business applications, such as customer relationship management (CRM) and enterprise resource planning (ERP) systems.

Best Accounting Software for Managing Accounts Receivable and Payable

Based on their features, functionality, and user reviews, here are some of the best accounting software for managing accounts receivable and payable:

- QuickBooks: QuickBooks is a popular accounting software that offers a range of features, including invoicing, payment tracking, and accounts receivable and payable management.

- Xero: Xero is a cloud-based accounting software that provides automated invoicing, payment tracking, and bank reconciliation, as well as detailed reporting and analytics.

- Zoho Books: Zoho Books is an affordable accounting software that offers features such as invoicing, payment tracking, and accounts receivable and payable management, as well as integration with other Zoho applications.

- FreshBooks: FreshBooks is a cloud-based accounting software that provides features such as invoicing, payment tracking, and time tracking, as well as integration with other business applications.

- Sage: Sage is a comprehensive accounting software that offers features such as invoicing, payment tracking, and accounts receivable and payable management, as well as advanced reporting and analytics.

Benefits of Using Accounting Software for Managing Accounts Receivable and Payable

By using accounting software to manage your accounts receivable and payable, you can:

- Improve Cash Flow: Automated invoicing and payment tracking help ensure timely payments from customers, improving your cash flow.

- Reduce Errors: Automated accounting processes minimize the risk of errors, ensuring that your financial records are accurate and up-to-date.

- Enhance Visibility: Real-time reporting and analytics provide valuable insights into your company’s financial performance, enabling you to make informed decisions.

- Streamline Operations: Automated accounting processes free up your time to focus on other aspects of your business, improving productivity and efficiency.

- Scalability: Cloud-based accounting software can grow with your business, providing a scalable solution for managing your accounts receivable and payable.

Common Challenges and Solutions

While using accounting software can simplify managing accounts receivable and payable, you may encounter some common challenges. Here are some solutions to these challenges:

- Data Migration: When switching to new accounting software, you may need to migrate your existing data. Look for software that offers data import tools or partner with a migration expert.

- User Adoption: Ensure that your team is properly trained on the new software, and provide ongoing support to address any questions or concerns.

- Integration: If you’re using other business applications, ensure that your accounting software integrates seamlessly with these systems, reducing errors and improving efficiency.

- Security: Choose software that provides robust security features, such as encryption and two-factor authentication, to protect your financial data.

Frequently Asked Questions (FAQ)

- What is the best accounting software for small businesses?

The best accounting software for small businesses depends on their specific needs and requirements. Popular options include QuickBooks, Xero, and Zoho Books. - How do I choose the right accounting software for my business?

Consider factors such as features, pricing, scalability, and user reviews when selecting accounting software for your business. - Can I use accounting software to manage my personal finances?

While accounting software is designed for business use, some personal finance software, such as Mint or Personal Capital, can help you manage your personal finances. - Is cloud-based accounting software secure?

Reputable cloud-based accounting software providers, such as QuickBooks and Xero, offer robust security features, including encryption and two-factor authentication, to protect your financial data. - Can I integrate accounting software with other business applications?

Yes, many accounting software solutions offer integration with other business applications, such as CRM and ERP systems, to streamline your financial operations.

Conclusion

Managing accounts receivable and payable is a critical aspect of financial management for businesses. By using accounting software, you can streamline your financial operations, improve cash flow, and make informed decisions. When selecting accounting software, consider key features such as invoicing, payment tracking, and accounts receivable and payable management, as well as reporting and analytics. Popular accounting software options include QuickBooks, Xero, and Zoho Books. By choosing the right accounting software for your business, you can overcome common challenges, such as data migration and user adoption, and achieve greater efficiency and productivity in your financial operations. Remember to evaluate your business needs, consider user reviews, and opt for software that provides robust security features to protect your financial data. With the right accounting software, you can take control of your company’s finances and drive long-term success.

Closure

Thus, we hope this article has provided valuable insights into Effective Account Management: Best Accounting Software for Managing Accounts Receivable and Payable. We appreciate your attention to our article. See you in our next article!