As a self-employed individual, managing your finances can be a daunting task. With multiple income streams, expenses, and tax obligations to keep track of, it’s easy to get overwhelmed. However, with the right accounting software, you can streamline your financial management and focus on growing your business. In this article, we’ll explore the benefits of simple cloud accounting software for self-employed individuals and provide an overview of the features and options available.

What is Cloud Accounting Software?

Cloud accounting software is a type of accounting software that is hosted online, rather than on your local computer or server. This means that you can access your accounting data from anywhere, at any time, as long as you have an internet connection. Cloud accounting software is typically provided as a subscription-based service, where you pay a monthly or annual fee to use the software.

Benefits of Cloud Accounting Software for Self-Employed Individuals

There are many benefits to using cloud accounting software as a self-employed individual. Some of the most significant advantages include:

- Accessibility: With cloud accounting software, you can access your financial data from anywhere, at any time. This means that you can manage your finances on the go, whether you’re working from a coffee shop, a co-working space, or your home office.

- Scalability: Cloud accounting software is highly scalable, which means that it can grow with your business. Whether you’re just starting out or you’re an established entrepreneur, cloud accounting software can adapt to your changing needs.

- Collaboration: Cloud accounting software makes it easy to collaborate with your accountant, bookkeeper, or other financial advisors. You can grant them access to your financial data, and they can provide you with real-time advice and support.

- Automatic Updates: Cloud accounting software is automatically updated by the provider, which means that you don’t have to worry about installing new versions or patches. This ensures that you always have the latest features and security updates.

- Cost-Effective: Cloud accounting software is often more cost-effective than traditional accounting software. You don’t have to pay for hardware or software upgrades, and you can cancel your subscription at any time.

Features of Simple Cloud Accounting Software

Simple cloud accounting software typically includes a range of features that are designed to meet the needs of self-employed individuals. Some of the most common features include:

- Invoice Creation: The ability to create and send professional-looking invoices to clients.

- Expense Tracking: The ability to track and categorize expenses, including receipts and payments.

- Income Tracking: The ability to track and categorize income, including sales and revenue.

- Tax Calculation: The ability to calculate and prepare tax returns, including sales tax and income tax.

- Bank Reconciliation: The ability to reconcile bank statements and ensure that your financial data is accurate.

- Reporting: The ability to generate financial reports, including balance sheets, income statements, and cash flow statements.

Popular Simple Cloud Accounting Software Options

There are many simple cloud accounting software options available for self-employed individuals. Some of the most popular options include:

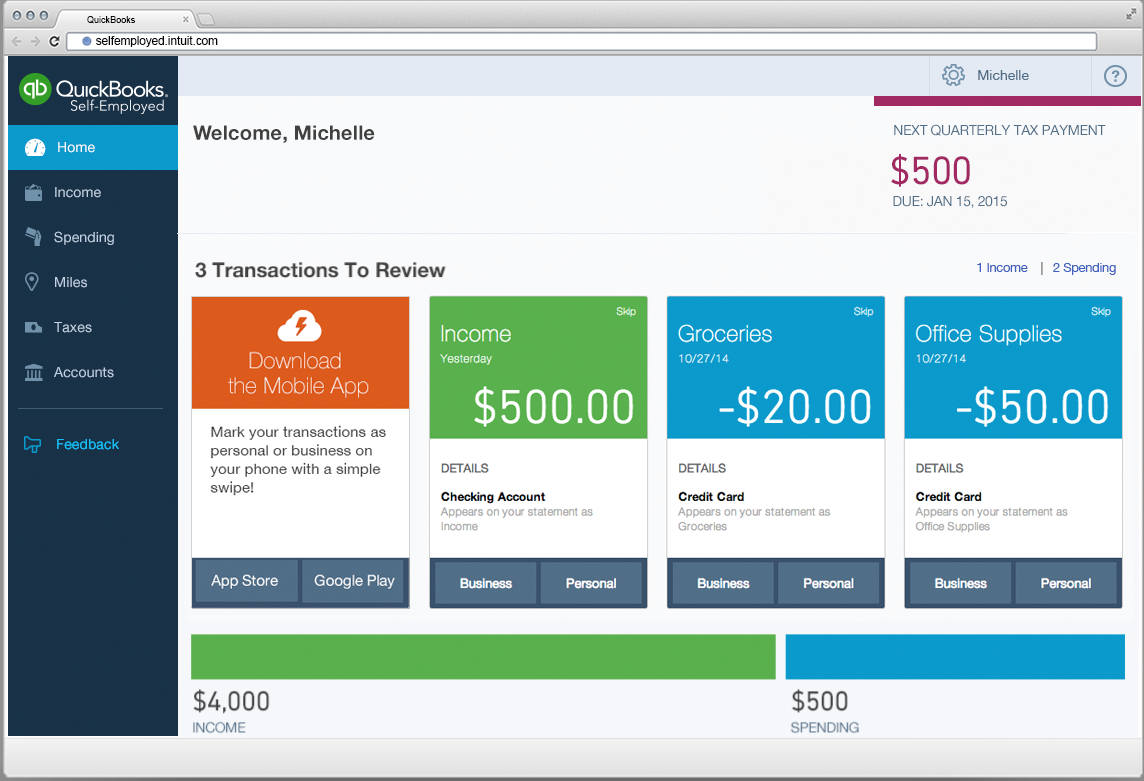

- QuickBooks Online: A comprehensive accounting software that includes features such as invoice creation, expense tracking, and tax calculation.

- Xero: A cloud-based accounting software that includes features such as bank reconciliation, reporting, and collaboration tools.

- Wave: A free cloud accounting software that includes features such as invoice creation, expense tracking, and payment processing.

- Zoho Books: A cloud-based accounting software that includes features such as invoice creation, expense tracking, and project management.

Choosing the Right Simple Cloud Accounting Software

With so many simple cloud accounting software options available, it can be difficult to choose the right one for your business. Here are some factors to consider when selecting a cloud accounting software:

- Ease of Use: Look for software that is easy to use and navigate, even if you have limited accounting experience.

- Features: Consider the features that you need, such as invoice creation, expense tracking, and tax calculation.

- Scalability: Choose software that can grow with your business, and that provides flexible pricing plans.

- Integration: Consider software that integrates with other tools and services that you use, such as payment processors and banks.

- Support: Look for software that provides excellent customer support, including online resources, phone support, and email support.

FAQ

Q: What is the best simple cloud accounting software for self-employed individuals?

A: The best simple cloud accounting software for self-employed individuals will depend on your specific needs and preferences. However, popular options include QuickBooks Online, Xero, Wave, and Zoho Books.

Q: How much does simple cloud accounting software cost?

A: The cost of simple cloud accounting software varies depending on the provider and the features that you need. However, most cloud accounting software providers offer flexible pricing plans, including monthly and annual subscriptions.

Q: Is simple cloud accounting software secure?

A: Yes, simple cloud accounting software is highly secure. Most cloud accounting software providers use advanced security measures, such as encryption and two-factor authentication, to protect your financial data.

Q: Can I use simple cloud accounting software on my mobile device?

A: Yes, most simple cloud accounting software providers offer mobile apps that allow you to access your financial data on the go.

Q: Do I need to have accounting experience to use simple cloud accounting software?

A: No, you don’t need to have accounting experience to use simple cloud accounting software. Most cloud accounting software providers offer easy-to-use interfaces and online resources to help you get started.

Conclusion

Simple cloud accounting software is a powerful tool for self-employed individuals who want to streamline their financial management and focus on growing their business. With its accessibility, scalability, collaboration, automatic updates, and cost-effectiveness, cloud accounting software is an essential tool for any entrepreneur. By considering the features and options available, and choosing the right software for your needs, you can simplify your financial management and achieve your business goals. Whether you’re just starting out or you’re an established entrepreneur, simple cloud accounting software is a valuable investment that can help you succeed.

Closure

Thus, we hope this article has provided valuable insights into Simple Cloud Accounting Software for Self-Employed Individuals: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!