As a business owner, managing finances and keeping track of invoices can be a daunting task. With the numerous invoicing accounting software available in the market, it can be overwhelming to choose the right one that meets your needs. In this article, we will review the best invoicing accounting software with tax reporting capabilities, highlighting their features, benefits, and pricing plans.

Why Invoicing Accounting Software is Important

Invoicing accounting software is essential for businesses of all sizes, as it helps to streamline financial management, reduce errors, and increase efficiency. The right software can help you to:

- Create and send professional invoices to clients

- Track payments and manage cash flow

- Generate financial reports and statements

- Analyze business performance and make informed decisions

- Comply with tax regulations and deadlines

Top Invoicing Accounting Software with Tax Reporting

- QuickBooks: QuickBooks is a popular and widely used invoicing accounting software that offers robust tax reporting features. It allows you to create and send invoices, track payments, and manage cash flow. QuickBooks also integrates with various tax preparation software, making it easy to prepare and file tax returns.

- Xero: Xero is a cloud-based invoicing accounting software that offers advanced tax reporting features, including automatic tax calculations and GST/VAT support. It also integrates with various payment gateways, making it easy to receive payments from clients.

- Wave: Wave is a comprehensive invoicing accounting software that offers tax reporting features, including automatic tax calculations and sales tax support. It also offers a range of payment processing options, including credit card payments and bank transfers.

- FreshBooks: FreshBooks is a cloud-based invoicing accounting software that offers tax reporting features, including automatic tax calculations and sales tax support. It also offers a range of payment processing options, including credit card payments and bank transfers.

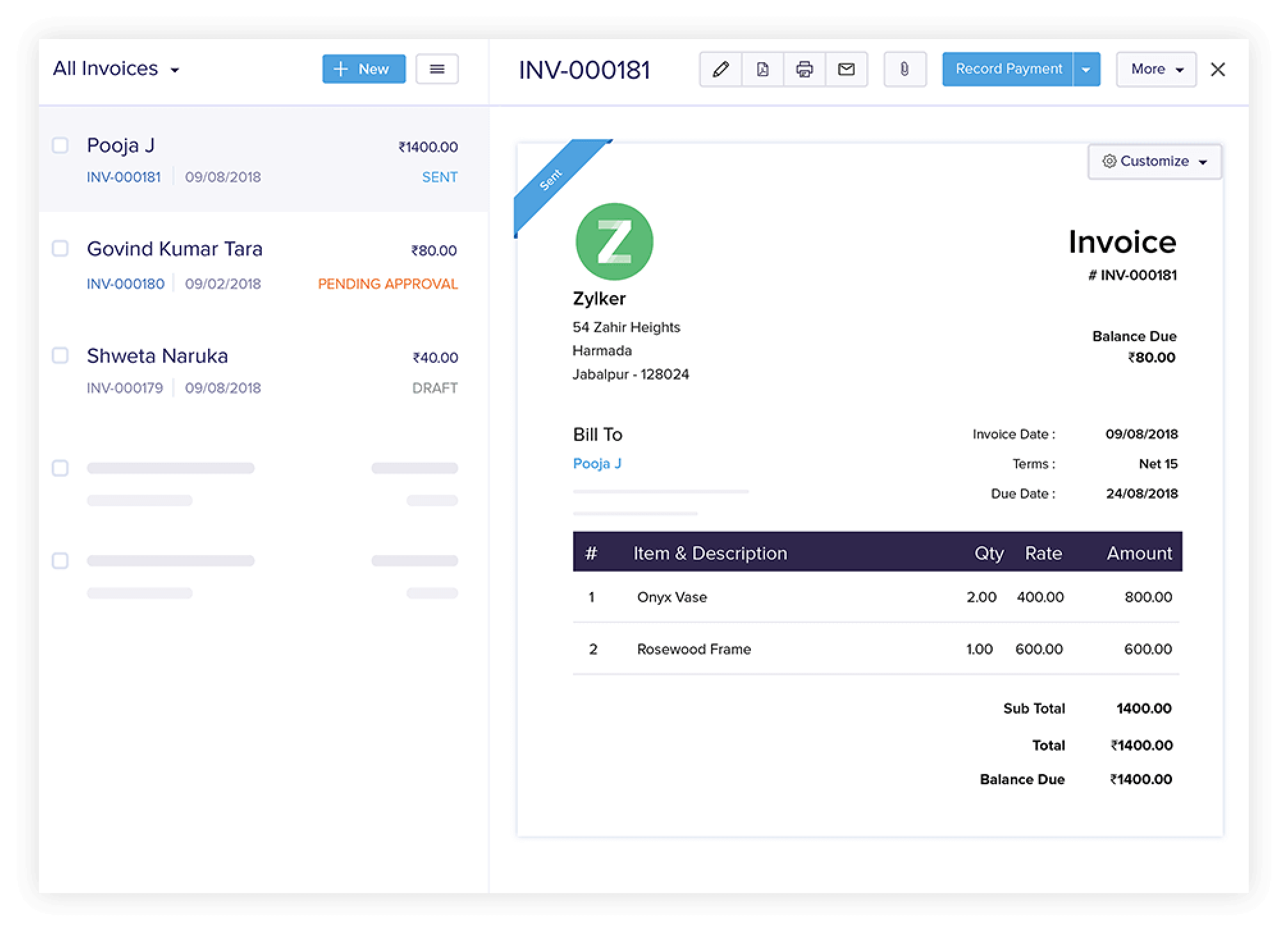

- Zoho Books: Zoho Books is a comprehensive invoicing accounting software that offers tax reporting features, including automatic tax calculations and GST/VAT support. It also integrates with various payment gateways, making it easy to receive payments from clients.

Features to Look for in Invoicing Accounting Software

When choosing invoicing accounting software, there are several features to look for, including:

- Tax reporting: The software should be able to generate tax reports and statements, including GST/VAT returns and sales tax reports.

- Invoicing: The software should allow you to create and send professional invoices to clients, with options for customization and branding.

- Payment processing: The software should offer a range of payment processing options, including credit card payments and bank transfers.

- Cash flow management: The software should allow you to track and manage cash flow, including accounts payable and accounts receivable.

- Financial reporting: The software should be able to generate financial reports and statements, including balance sheets and income statements.

Benefits of Using Invoicing Accounting Software

Using invoicing accounting software can bring numerous benefits to your business, including:

- Increased efficiency: Invoicing accounting software can automate many financial tasks, freeing up time for more important tasks.

- Improved accuracy: Invoicing accounting software can reduce errors and inaccuracies, ensuring that financial reports and statements are accurate and reliable.

- Enhanced financial management: Invoicing accounting software can provide real-time financial insights, allowing you to make informed decisions and manage cash flow effectively.

- Compliance with tax regulations: Invoicing accounting software can help you to comply with tax regulations and deadlines, reducing the risk of penalties and fines.

Pricing Plans

The pricing plans for invoicing accounting software vary depending on the software and the features offered. Here are some approximate pricing plans for the software mentioned above:

- QuickBooks: $10-$30 per month

- Xero: $9-$30 per month

- Wave: $0-$19 per month

- FreshBooks: $15-$50 per month

- Zoho Books: $9-$25 per month

FAQ

- What is invoicing accounting software?

Invoicing accounting software is a type of software that helps businesses to manage finances, create and send invoices, and track payments. - What are the benefits of using invoicing accounting software?

The benefits of using invoicing accounting software include increased efficiency, improved accuracy, enhanced financial management, and compliance with tax regulations. - What features should I look for in invoicing accounting software?

Features to look for in invoicing accounting software include tax reporting, invoicing, payment processing, cash flow management, and financial reporting. - How much does invoicing accounting software cost?

The cost of invoicing accounting software varies depending on the software and the features offered, but approximate pricing plans range from $0-$50 per month. - Is invoicing accounting software suitable for small businesses?

Yes, invoicing accounting software is suitable for small businesses, as it can help to streamline financial management, reduce errors, and increase efficiency.

Conclusion

Invoicing accounting software is an essential tool for businesses of all sizes, as it helps to streamline financial management, reduce errors, and increase efficiency. With the numerous software options available, it can be overwhelming to choose the right one that meets your needs. By considering the features, benefits, and pricing plans of the software mentioned above, you can make an informed decision and choose the best invoicing accounting software with tax reporting capabilities for your business. Remember to look for software that offers tax reporting, invoicing, payment processing, cash flow management, and financial reporting features, and to choose a pricing plan that suits your business needs. By using invoicing accounting software, you can simplify financial management, reduce errors, and focus on growing your business.

Closure

Thus, we hope this article has provided valuable insights into The Best Invoicing Accounting Software with Tax Reporting: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!