In today’s digital age, managing a business’s finances has become more efficient and streamlined, thanks to the numerous invoicing and accounting software available in the market. These software programs have revolutionized the way businesses handle their financial transactions, invoicing, and accounting, making it easier to track expenses, create invoices, and manage cash flow. In this article, we will explore the best invoicing and accounting software, their features, and benefits, to help you make an informed decision for your business.

What is Invoicing and Accounting Software?

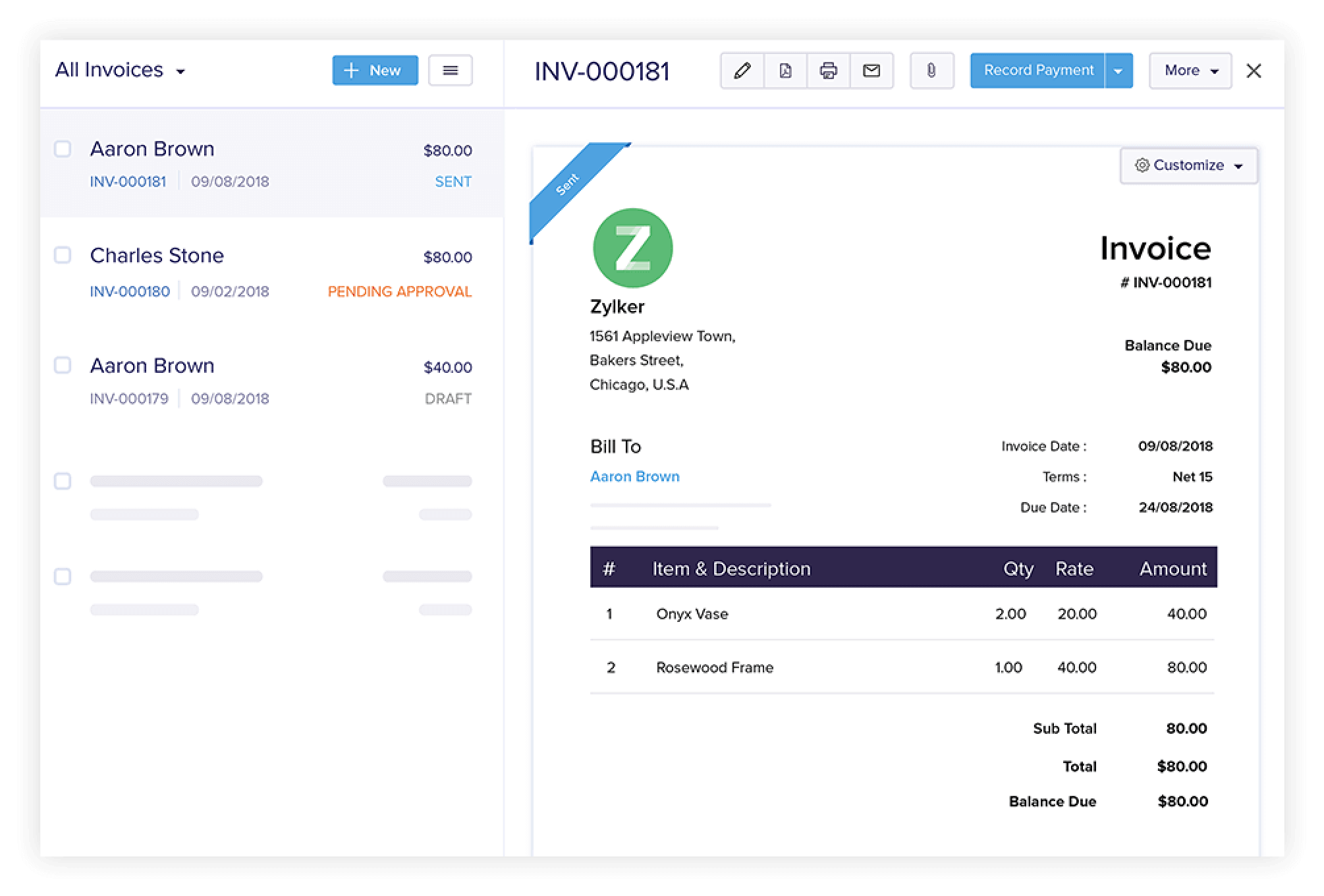

Invoicing and accounting software is a type of computer program that helps businesses manage their financial transactions, create invoices, and track expenses. This software is designed to automate various accounting tasks, such as invoicing, billing, and financial reporting, making it easier for businesses to manage their finances. The software typically includes features such as:

- Invoicing and billing

- Expense tracking

- Financial reporting

- Accounts payable and accounts receivable management

- Tax calculation and compliance

- Integration with payment gateways and banks

Benefits of Using Invoicing and Accounting Software

Using invoicing and accounting software can bring numerous benefits to a business, including:

- Improved accuracy: Automated accounting tasks reduce the likelihood of human error, ensuring accurate financial records.

- Increased efficiency: The software streamlines financial processes, saving time and reducing the workload.

- Enhanced financial visibility: Real-time financial reporting and dashboards provide a clear picture of the business’s financial health.

- Better cash flow management: The software helps businesses track expenses, create invoices, and manage cash flow, ensuring timely payments and reducing the risk of late payments.

- Compliance: The software ensures tax compliance and adherence to accounting standards, reducing the risk of penalties and fines.

Top Invoicing and Accounting Software

Here are some of the best invoicing and accounting software available in the market:

- QuickBooks: QuickBooks is a popular accounting software that offers a range of features, including invoicing, expense tracking, and financial reporting.

- Xero: Xero is a cloud-based accounting software that provides real-time financial reporting, invoicing, and expense tracking.

- FreshBooks: FreshBooks is a cloud-based invoicing and accounting software that offers features such as invoicing, expense tracking, and time tracking.

- Zoho Books: Zoho Books is a cloud-based accounting software that provides features such as invoicing, expense tracking, and financial reporting.

- Wave: Wave is a cloud-based accounting software that offers features such as invoicing, expense tracking, and financial reporting.

Features to Consider When Choosing Invoicing and Accounting Software

When choosing invoicing and accounting software, consider the following features:

- Ease of use: Choose software that is easy to use and navigate.

- Scalability: Select software that can grow with your business.

- Integration: Consider software that integrates with other business applications, such as payment gateways and banks.

- Security: Choose software that provides robust security features, such as data encryption and backup.

- Customer support: Select software that offers reliable customer support, such as phone, email, and live chat support.

Pricing and Plans

The pricing and plans of invoicing and accounting software vary depending on the provider and the features offered. Here are some approximate pricing plans:

- QuickBooks: $10-$30 per month

- Xero: $9-$30 per month

- FreshBooks: $15-$50 per month

- Zoho Books: $9-$25 per month

- Wave: $15-$30 per month

FAQs

- What is the best invoicing and accounting software for small businesses?

The best invoicing and accounting software for small businesses depends on the specific needs of the business. However, popular options include QuickBooks, Xero, and FreshBooks. - Can I use invoicing and accounting software for free?

Some invoicing and accounting software providers offer free trials or limited free versions. However, most software requires a subscription or one-time payment. - Is invoicing and accounting software secure?

Reputable invoicing and accounting software providers offer robust security features, such as data encryption and backup, to protect business data. - Can I integrate invoicing and accounting software with other business applications?

Yes, many invoicing and accounting software providers offer integration with other business applications, such as payment gateways and banks. - What is the best way to migrate to new invoicing and accounting software?

The best way to migrate to new invoicing and accounting software is to consult with the software provider and follow their migration process, which typically includes data import, setup, and training.

Conclusion

Invoicing and accounting software is an essential tool for businesses of all sizes, providing a streamlined and efficient way to manage financial transactions, create invoices, and track expenses. With numerous software options available, it’s essential to choose the right software that meets your business needs and budget. By considering features such as ease of use, scalability, integration, security, and customer support, you can select the best invoicing and accounting software for your business. Whether you’re a small business or a large enterprise, invoicing and accounting software can help you improve accuracy, increase efficiency, and enhance financial visibility, ultimately driving business growth and success.

Closure

Thus, we hope this article has provided valuable insights into The Best Invoicing and Accounting Software: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!