In today’s fast-paced business environment, managing customer payments and invoicing is a crucial aspect of maintaining a healthy cash flow and ensuring the financial stability of an organization. Traditional methods of managing payments and invoicing can be time-consuming, prone to errors, and often lead to delayed payments and lost revenue. This is where accounting software comes in – to streamline and automate the process of managing customer payments and invoicing.

What is Accounting Software?

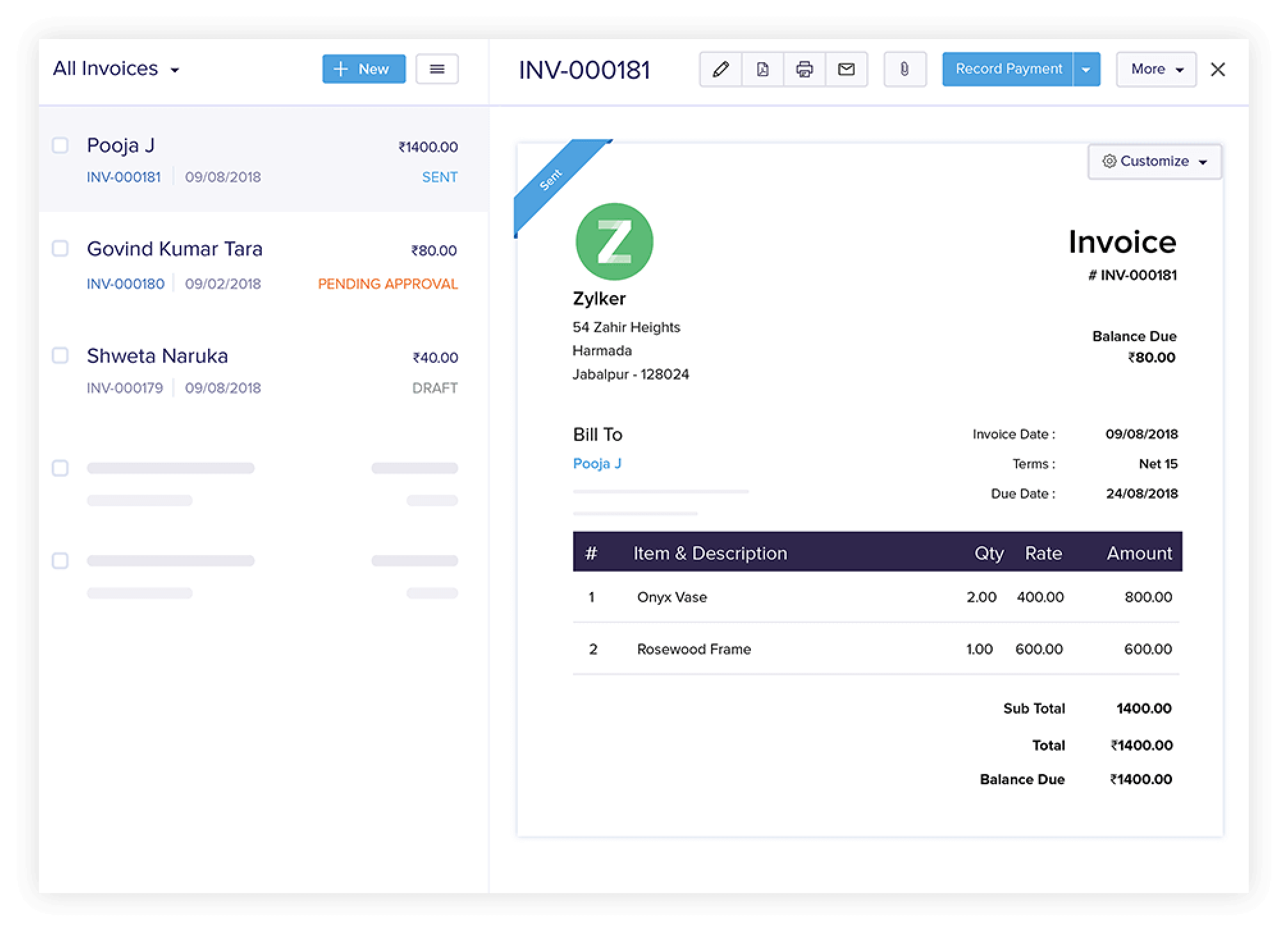

Accounting software is a type of computer program designed to manage and automate various accounting tasks, including customer payments and invoicing. It provides a centralized platform for businesses to track and record financial transactions, generate invoices, and manage customer accounts. Accounting software can be used by businesses of all sizes, from small startups to large enterprises, and can be customized to meet the specific needs of each organization.

Benefits of Using Accounting Software for Managing Customer Payments and Invoicing

There are several benefits of using accounting software for managing customer payments and invoicing, including:

- Improved Accuracy: Accounting software reduces the risk of human error, ensuring that invoices are accurate and payments are recorded correctly.

- Increased Efficiency: Automated invoicing and payment processing saves time and reduces the workload of accounting staff, allowing them to focus on other important tasks.

- Enhanced Customer Experience: Accounting software enables businesses to provide customers with easy online payment options, improving the overall customer experience and reducing the likelihood of late payments.

- Better Cash Flow Management: Accounting software provides real-time visibility into cash flow, enabling businesses to make informed decisions about investments, funding, and other financial matters.

- Compliance with Regulations: Accounting software helps businesses comply with regulatory requirements, such as tax laws and accounting standards, reducing the risk of non-compliance and associated penalties.

Key Features of Accounting Software for Managing Customer Payments and Invoicing

When selecting accounting software for managing customer payments and invoicing, there are several key features to look for, including:

- Invoicing and Billing: The ability to generate professional-looking invoices and bills, with options for customization and automation.

- Online Payment Processing: Integration with online payment gateways, such as PayPal or Stripe, to facilitate easy and secure payments.

- Customer Management: A centralized customer database, allowing businesses to track customer interactions, payments, and account history.

- Payment Reminders and Notifications: Automated reminders and notifications to customers regarding upcoming payments, overdue invoices, and other important events.

- Reporting and Analytics: Advanced reporting and analytics capabilities, providing insights into cash flow, customer behavior, and other key performance indicators.

Popular Accounting Software for Managing Customer Payments and Invoicing

There are many accounting software solutions available on the market, each with its own strengths and weaknesses. Some popular options include:

- QuickBooks: A comprehensive accounting software solution, offering advanced features for invoicing, billing, and payment processing.

- Xero: A cloud-based accounting software, providing a user-friendly interface and advanced features for managing customer payments and invoicing.

- Wave: A free accounting software solution, offering a range of features for invoicing, billing, and payment processing, as well as advanced reporting and analytics.

- Zoho Books: A cloud-based accounting software, providing a comprehensive range of features for managing customer payments and invoicing, as well as inventory management and project accounting.

Implementing Accounting Software for Managing Customer Payments and Invoicing

Implementing accounting software for managing customer payments and invoicing requires careful planning and execution. Here are some steps to follow:

- Assess Your Needs: Evaluate your business requirements, including the number of customers, invoices, and payments to be managed.

- Choose the Right Software: Select an accounting software solution that meets your business needs, with features for invoicing, billing, and payment processing.

- Configure the Software: Set up the software, including customization of invoices, bills, and payment reminders.

- Train Staff: Provide training to accounting staff on the use of the software, ensuring a smooth transition from traditional methods.

- Monitor and Evaluate: Continuously monitor and evaluate the performance of the software, making adjustments as necessary to optimize its use.

Frequently Asked Questions (FAQs)

- Q: What is the cost of accounting software for managing customer payments and invoicing?

A: The cost of accounting software varies depending on the solution, with some options available for free, while others require a monthly or annual subscription fee. - Q: Is accounting software secure?

A: Yes, most accounting software solutions are secure, with features such as encryption, firewalls, and access controls to protect sensitive financial data. - Q: Can accounting software be customized?

A: Yes, many accounting software solutions can be customized to meet the specific needs of a business, including branding, invoicing, and payment processing. - Q: Is accounting software compatible with other business applications?

A: Yes, many accounting software solutions are compatible with other business applications, such as CRM, ERP, and e-commerce platforms. - Q: What kind of support is available for accounting software?

A: Most accounting software solutions offer a range of support options, including online documentation, phone support, and email support.

Conclusion

In conclusion, accounting software is a vital tool for managing customer payments and invoicing, providing a range of benefits, including improved accuracy, increased efficiency, and enhanced customer experience. When selecting accounting software, it’s essential to consider key features, such as invoicing and billing, online payment processing, and customer management. By implementing accounting software and following best practices, businesses can streamline their financial management processes, reduce errors, and improve cash flow. Whether you’re a small startup or a large enterprise, accounting software can help you manage customer payments and invoicing with ease, allowing you to focus on growing your business and achieving success.

Closure

Thus, we hope this article has provided valuable insights into The Importance of Accounting Software for Managing Customer Payments and Invoicing. We appreciate your attention to our article. See you in our next article!