In today’s globalized business landscape, managing sales tax and Value-Added Tax (VAT) is a complex and time-consuming task. With the ever-changing tax laws and regulations, it’s essential for businesses to have an efficient and reliable accounting system in place to ensure compliance and avoid penalties. Accounting software has become an indispensable tool for managing sales tax and VAT, helping businesses to streamline their financial processes, reduce errors, and improve overall productivity.

What is Sales Tax and VAT?

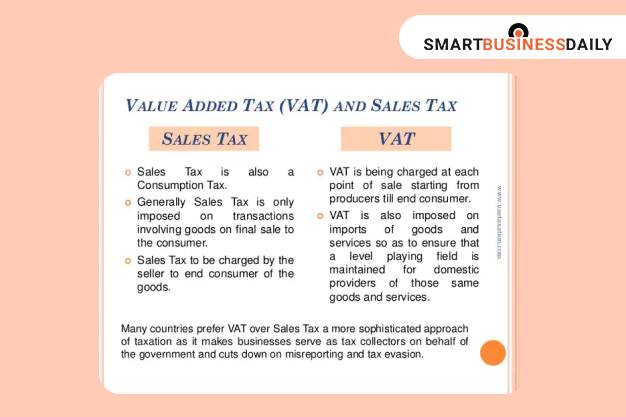

Sales tax and VAT are types of consumption taxes levied on the sale of goods and services. Sales tax is typically imposed by state or local governments, while VAT is a federal tax imposed by the central government. The key difference between the two is that sales tax is applied only to the final sale of a product, whereas VAT is applied at each stage of production and distribution.

The Challenges of Managing Sales Tax and VAT

Managing sales tax and VAT can be a daunting task, especially for businesses that operate in multiple jurisdictions. Some of the common challenges include:

- Complexity of tax laws and regulations: Tax laws and regulations are constantly changing, making it difficult for businesses to keep up with the latest developments.

- Multiple tax rates and exemptions: Different jurisdictions have different tax rates and exemptions, which can be confusing and time-consuming to manage.

- Compliance and reporting requirements: Businesses must comply with various reporting requirements, such as filing tax returns and maintaining accurate records.

- Risk of errors and penalties: Errors in tax calculations or reporting can result in penalties and fines, which can be costly and damaging to a business’s reputation.

How Accounting Software Can Help

Accounting software can help businesses manage sales tax and VAT by providing a range of features and tools, including:

- Automated tax calculations: Accounting software can automatically calculate sales tax and VAT based on the business’s location, type of goods or services sold, and other relevant factors.

- Tax rate and exemption management: Accounting software can help businesses manage multiple tax rates and exemptions, ensuring that the correct tax rates are applied to each transaction.

- Compliance and reporting: Accounting software can generate tax returns and other reports, ensuring that businesses comply with all relevant tax laws and regulations.

- Error reduction and audit trail: Accounting software can reduce errors and provide an audit trail, which can help businesses to identify and correct mistakes, and demonstrate compliance to auditors and tax authorities.

Features to Look for in Accounting Software

When selecting accounting software for managing sales tax and VAT, businesses should look for the following features:

- Tax rate and exemption management: The ability to manage multiple tax rates and exemptions, including the ability to set up and maintain tax rates, exemptions, and thresholds.

- Automated tax calculations: The ability to automatically calculate sales tax and VAT based on the business’s location, type of goods or services sold, and other relevant factors.

- Compliance and reporting: The ability to generate tax returns and other reports, including the ability to customize reports to meet specific business needs.

- Integration with e-commerce platforms: The ability to integrate with e-commerce platforms, such as Shopify or Magento, to streamline sales tax and VAT management.

- Multi-currency support: The ability to support multiple currencies, which is essential for businesses that operate globally.

- Scalability and flexibility: The ability to scale and adapt to changing business needs, including the ability to add or remove features and users as needed.

Top Accounting Software for Managing Sales Tax and VAT

Some of the top accounting software for managing sales tax and VAT include:

- QuickBooks: A popular accounting software that offers a range of features, including automated tax calculations, tax rate and exemption management, and compliance and reporting.

- Xero: A cloud-based accounting software that offers a range of features, including automated tax calculations, tax rate and exemption management, and compliance and reporting.

- Sage: A comprehensive accounting software that offers a range of features, including automated tax calculations, tax rate and exemption management, and compliance and reporting.

- Zoho Books: A cloud-based accounting software that offers a range of features, including automated tax calculations, tax rate and exemption management, and compliance and reporting.

Frequently Asked Questions (FAQs)

- What is the difference between sales tax and VAT?

Sales tax is typically imposed by state or local governments, while VAT is a federal tax imposed by the central government. - How do I manage sales tax and VAT in my business?

You can manage sales tax and VAT by using accounting software that offers automated tax calculations, tax rate and exemption management, and compliance and reporting. - What are the benefits of using accounting software for managing sales tax and VAT?

The benefits of using accounting software for managing sales tax and VAT include automated tax calculations, reduced errors, improved compliance, and increased productivity. - Can I use accounting software to manage sales tax and VAT for my e-commerce business?

Yes, many accounting software solutions offer integration with e-commerce platforms, such as Shopify or Magento, to streamline sales tax and VAT management. - How do I choose the right accounting software for my business?

You should choose accounting software that offers the features and tools you need to manage sales tax and VAT, including automated tax calculations, tax rate and exemption management, and compliance and reporting.

Conclusion

Managing sales tax and VAT is a complex and time-consuming task, but with the right accounting software, businesses can streamline their financial processes, reduce errors, and improve overall productivity. By automating tax calculations, managing tax rates and exemptions, and ensuring compliance and reporting, accounting software can help businesses to navigate the complexities of sales tax and VAT. When selecting accounting software, businesses should look for features such as tax rate and exemption management, automated tax calculations, compliance and reporting, integration with e-commerce platforms, multi-currency support, and scalability and flexibility. By investing in the right accounting software, businesses can ensure that they are well-equipped to manage sales tax and VAT, and focus on growing and developing their business.

Closure

Thus, we hope this article has provided valuable insights into The Importance of Accounting Software for Managing Sales Tax and VAT. We appreciate your attention to our article. See you in our next article!