In today’s fast-paced business environment, managing finances and tracking expenses is crucial for any organization. With the rise of digital technology, accounting software has become an essential tool for businesses to streamline their financial processes. One of the key features of modern accounting software is employee expense management, which enables companies to efficiently track and manage employee expenses. In this article, we will explore the importance of accounting software with employee expense management and how it can benefit businesses.

What is Accounting Software with Employee Expense Management?

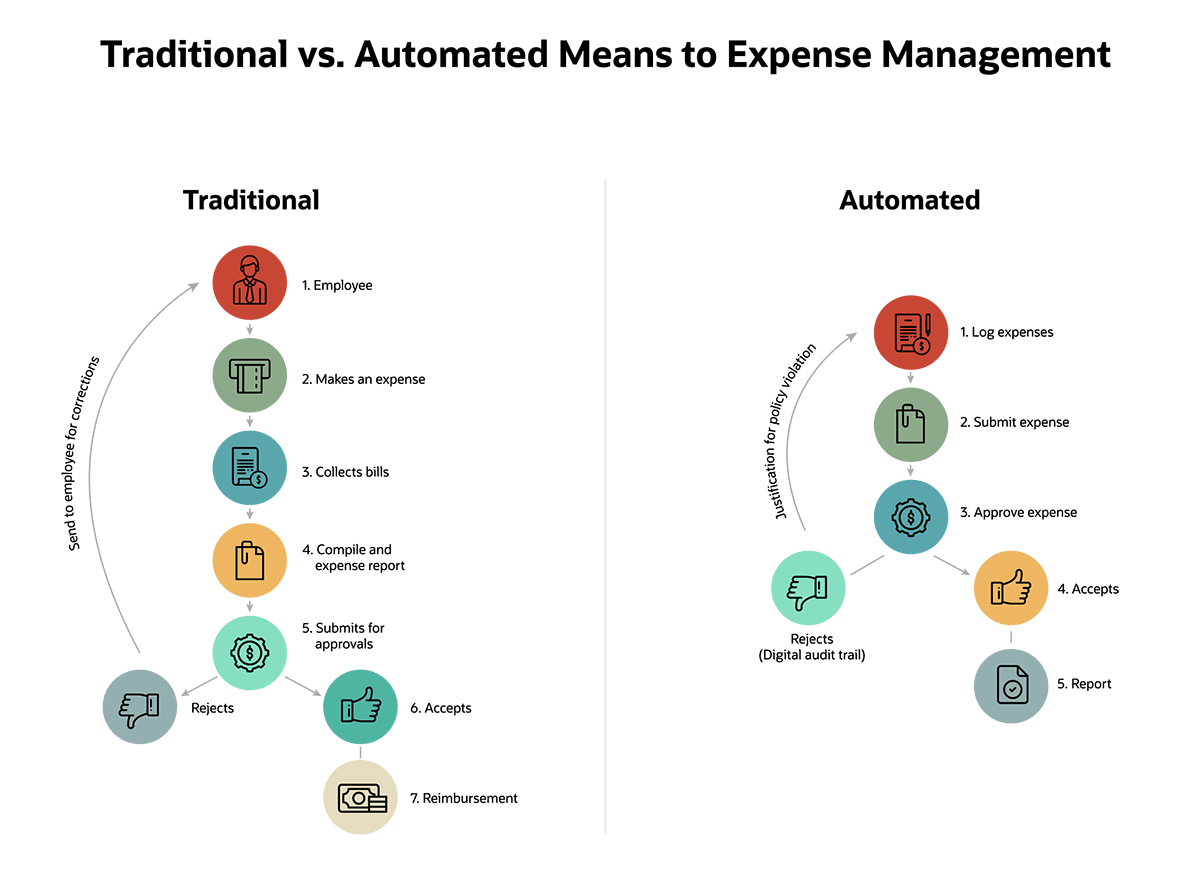

Accounting software with employee expense management is a type of financial management system that allows businesses to track and manage employee expenses, in addition to performing traditional accounting tasks such as invoicing, billing, and financial reporting. This software enables employees to submit expense reports and receipts electronically, which are then reviewed and approved by managers. The approved expenses are then automatically recorded in the company’s financial records, eliminating the need for manual data entry.

Benefits of Accounting Software with Employee Expense Management

The benefits of accounting software with employee expense management are numerous. Some of the most significant advantages include:

- Increased Efficiency: Automated expense reporting and approval processes save time and reduce the administrative burden on accounting staff.

- Improved Accuracy: Electronic expense reporting reduces errors and minimizes the risk of lost or misplaced receipts.

- Enhanced Visibility: Managers can view expense reports and receipts in real-time, enabling them to make informed decisions about company spending.

- Reduced Costs: Automated expense management helps companies to identify areas where costs can be reduced, such as unnecessary travel expenses or duplicate purchases.

- Scalability: Accounting software with employee expense management can grow with the business, accommodating an increasing number of employees and transactions.

- Compliance: This software helps companies comply with tax regulations and financial standards, such as the IRS mileage rate and per diem allowances.

- Employee Satisfaction: Electronic expense reporting and reimbursement processes are faster and more convenient for employees, improving their overall satisfaction with the company.

Key Features of Accounting Software with Employee Expense Management

When selecting accounting software with employee expense management, there are several key features to consider:

- Electronic Expense Reporting: Employees should be able to submit expense reports and receipts electronically, via a mobile app or web portal.

- Automated Approval Processes: Managers should be able to review and approve expense reports electronically, with notifications and reminders to ensure timely processing.

- Expense Tracking and Categorization: The software should enable companies to track and categorize expenses by type, department, or project.

- Mileage Tracking and Calculations: The software should be able to track and calculate mileage expenses, including automatic mileage rate updates.

- Per Diem Allowances: The software should be able to calculate and track per diem allowances for meals, lodging, and other expenses.

- Integration with Accounting Systems: The software should integrate seamlessly with existing accounting systems, such as QuickBooks or Xero.

- Mobile Accessibility: The software should be accessible on-the-go, via mobile apps or mobile-optimized web portals.

Examples of Accounting Software with Employee Expense Management

Some popular examples of accounting software with employee expense management include:

- Concur: A comprehensive expense management solution that integrates with accounting systems and provides automated approval processes.

- Expensify: A cloud-based expense reporting and tracking solution that enables employees to submit expense reports and receipts electronically.

- Zoho Expense: A web-based expense management solution that integrates with Zoho Books and other accounting systems.

- QuickBooks: A popular accounting software that includes employee expense management features, such as electronic expense reporting and automated approval processes.

- Xero: A cloud-based accounting software that includes employee expense management features, such as expense tracking and categorization.

Implementation and Training

To ensure a successful implementation of accounting software with employee expense management, companies should:

- Conduct a thorough evaluation: Assess the company’s expense management needs and evaluate different software solutions.

- Develop a training plan: Provide comprehensive training to employees and managers on the use of the software.

- Establish clear policies and procedures: Develop and communicate clear policies and procedures for expense reporting and reimbursement.

- Monitor and adjust: Continuously monitor the software’s performance and make adjustments as needed to ensure optimal use.

FAQs

- What is the cost of accounting software with employee expense management?

The cost of accounting software with employee expense management varies depending on the solution and the number of users. Some solutions offer a monthly subscription model, while others require a one-time purchase. - Is accounting software with employee expense management secure?

Yes, accounting software with employee expense management is secure. Most solutions use encryption, firewalls, and other security measures to protect sensitive financial data. - Can accounting software with employee expense management be customized?

Yes, many accounting software solutions with employee expense management can be customized to meet the specific needs of a company. - How long does it take to implement accounting software with employee expense management?

The implementation time for accounting software with employee expense management varies depending on the solution and the company’s size and complexity. Some solutions can be implemented in a matter of days, while others may require several weeks or months. - What kind of support is available for accounting software with employee expense management?

Most accounting software solutions with employee expense management offer support through phone, email, or online chat. Some solutions also offer comprehensive training and onboarding programs.

Conclusion

Accounting software with employee expense management is a powerful tool that can help businesses streamline their financial processes and improve their bottom line. By automating expense reporting and approval processes, companies can reduce administrative burdens, improve accuracy, and enhance visibility into company spending. With so many solutions available, companies can choose the one that best meets their needs and budget. By implementing accounting software with employee expense management, businesses can take a significant step towards improving their financial management and achieving long-term success.

Closure

Thus, we hope this article has provided valuable insights into The Importance of Accounting Software with Employee Expense Management. We appreciate your attention to our article. See you in our next article!